Table of Contents

Introduction

It goes without saying that credit cards are popular—a store with a ‘Cash Only’ sign evokes both a sense of nostalgia and light suspicion—and reliance on cards has only heightened with the world's collective germaphobia in the past few years. It only makes sense, then, that lenders want to finance these spending tools and collect interest on them.

But standing up a card program involves a lot of players, from a card network to an issuer to a ledger that can authorize payments and track how much money has been borrowed. That's where LoanPro comes in. We've built two key components: a servicing core to manage accounts, and card system that partners with issuers and networks to enable account holders to draw funds through a card transaction.

This article will explain that second part—the tools for making swipes—and Intro to Line of Credit Accounts explains how they're calculated and serviced.

Highlights

When a borrower swipes a card at a convenience store, they're probably thinking much more about the donut they're buying than the financial infrastructure that enables the purchase. But behind that simple transaction, there's a chain of interconnected companies and technologies.

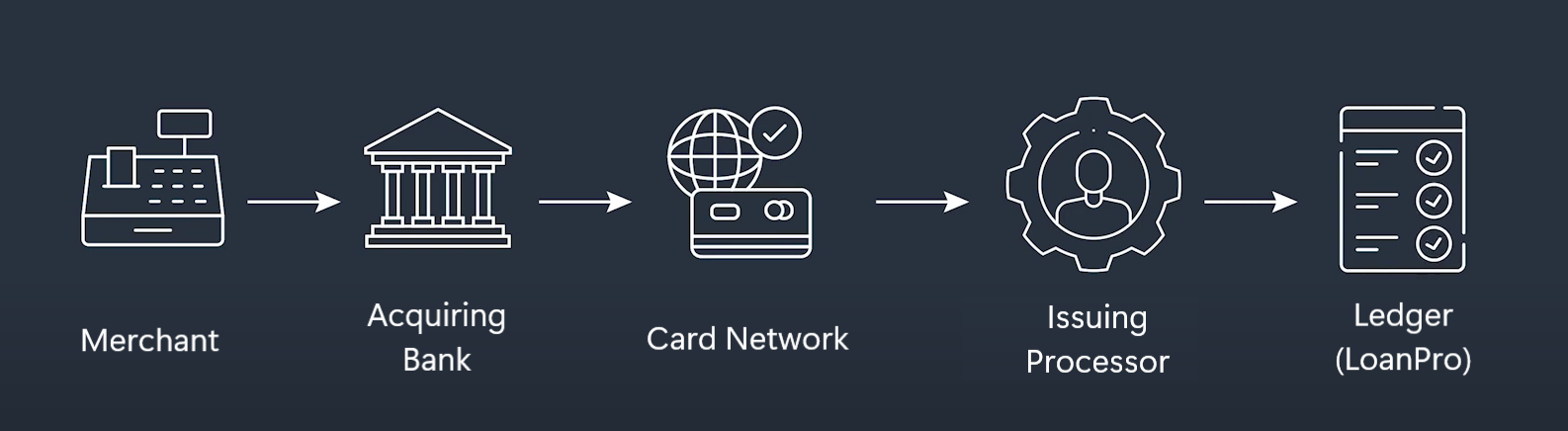

When a borrower makes a swipe, it typically follows this authorization path:

The merchant sends it to their acquiring bank, who passes it on to the card network. (That network is a company like Visa or American Express.) They route it to an issuing processor, which queries a ledger to make sure the borrower is allowed to make that swipe. In our system, LoanPro acts as the ledger. Then, the information flows back in the opposite direction, with approval going from the ledger to the issuer, then to the networks, the acquiring bank, and finally the merchant. Once the merchant receives confirmation that the swipe is approved, they can deliver their good or service (like a donut in our example above) and send the customer on their merry way. This achievement of the modern age happens in milliseconds.

Let's breakdown how LoanPro's card system works.

Cards and Lines of Credit

LoanPro provides two key components for your credit card lending operation:

- a system to create cards through an issuing processor and capture card transaction information

- a servicing core to calculate interest, service accounts, and collect payments.

When you create a borrower and line of credit account in LMS, our servicing core, you'll also be able to issue the borrower a card which they can use to access their available balance. You can enter that borrower's card-associated information in the more user-friendly LMS, and then it'll be saved in our PCI-compliant software, Secure Payments.

From Secure Payments, that card is connected to the issuer and card networks on one side and LMS on the other. When a borrower makes a swipe, the information goes through the authorization path to the Secure Payments authorization service. Since Secure Payments stores all the card's information (like an available balance and swipe limits), it can authorize the transaction without querying LMS. When Secure Payments approves the transaction, it sends that information back through the authorization path and to LMS. LMS then routes the transaction into the correct bucket and updates the account's available balance, including an update to the Secure Payments authorization service so it's balance information will be accurate.

Structure and Hierarchy

In Secure Payments, there's a basic structure to the card system. Each level of this hierarchy is a one-to-many relationship; a single card can have hundreds of swipes, but a swipe can't be shared between two cards.

- Secure Payments Account. Each lender using LoanPro gets an account with Secure Payments, our PCI-compliant system for storing card and payment profile data.

- Issuing Processors. Within your Secure Payments account, you can integrate with multiple issuers by connecting the your issuing partners to the Secure Payments API. (See the BYOI tab for more on that subject.)

- Card Programs. A card program is the template used to create cards. This is similar to the line of credit programs in LMS, but not the same. Both are templates, but they create different entities. A line of credit program creates accounts, and controls things like buckets, interest calculation, and servicing defaults. A card program creates cards, and controls the issuer, network, and what kind of swipes are blocked. An issuer can support multiple card programs, but each card program is limited to using a single issuer.

- Cards. You can use card programs to create cards for borrowers. It inherits all of its settings from the card program, except for the borrower-specific info like their name and billing address. Most of those settings can be edited on individual cards, but the card is locked in to the issuer and network that the program uses. Cards can be physical pieces of plastic, electronic cards (like the card you might have saved in your smartphone), or both.

- Swipes. These are transactions where a borrower uses the card to pay a merchant. Swipes can be a single transaction that authorizes funds and makes the payment, or they can be broken down into an authorization message that approves the transaction and a clearing message that actually moves money. (That two-step swipe is common for transactions where it's not immediately clear what the exact cost will be, like filling up a tank of gas. The authorization message makes sure the card has enough money, and the clearing message charges them for a specific amount.)

- Swipe Events. When a swipe gets cleared, voided, returned, or otherwise modified, that change comes into Secure Payments as a swipe event, saved to a specific swipe.

BYOI

LoanPro's Bring-Your-Own-Issuer (BYOI) infrastructure allows us to work with the card issuer of your choice, whomever that may be. You have complete flexibility in the network and issuer you work with.

Once you've selected an issuer (or several issuers), you can use the Secure Payments API to connect them to our system. Secure Payments is already connected to LMS, so the issuer doesn't actually need to touch LMS directly.

API and Webhooks

Secure Payment's API and Webhooks let lenders connect any issuer and card network into our card system and servicing core.

Webhooks let Secure Payments communicate with LMS and other software when certain events happen, like card creation or swipes.

The Secure Payments API is how you can get your information into Secure Payments. There's plenty of calls you can use (like those to add new card programs or edit a card's transaction limits), but these are especially important:

- Creating a New Card. While some lenders might be content to use our UI to add cards, we anticipate most lenders will want to use their own website or customer portal to handle card applications. This call will let your application send that borrower's information into Secure Payments.

- Log a Swipe. When a swipe comes in from the authorization path, this is the call you'll use to send it into Secure Payments. This is essential for authorizing and recording new swipe transactions.

- Swipe Events. These endpoints will let you modify a swipe. Not only is this used to void or refund a transaction, but it's also an essential part of dual message system (DMS) transactions, where a first message puts a hold on funds, and then a second clears a specific dollar amount.

We're still working on public documentation for these API calls, but when they're ready, we'll put them on the Secure Payments ReadMe page.

In the meantime, however, a Postman collection is available upon request. Reach out to a LoanPro representative and they'll send it over.

Where Does Card Fit?

LoanPro's card features let your borrowers access credit how and when they want, but what really makes our card system special is its connection to Line of Credit in LMS. It's a combination of the ease and convenience that borrowers love, and the unmatched calculation and servicing capabilities that make lenders money.

This Feature is Not

Let's clear up some possible misconceptions about how cards works in our system.

- Card is not synonymous with Line of Credit. A line of credit account lets borrowers borrow money incrementally, pay it off in cycles, and then borrow that money again. A card is a common and convenient method for accessing those funds, but its not the only way—you might extend revolving cash loans and with the same calculations, but no actual card. And in our system, a single line of credit account can be accessed through multiple cards, making it easy to set up large accounts that are shared between multiple cardholders in an organization.

- Cards are not saved in LMS. True, you can add them in LMS, but the actual card information is stored in Secure Payments. This is the same arrangement we use for borrower's payment profiles. Sensitive payment data is kept safe and sound within a PCI-compliant software, and LMS can remain user-friendly since it's outside the scope of PCI compliance.

What’s Next?

In the near future, we'll have more documentation about cards, issuers, and everything else we've discussed in this article. In the meantime, though, you'll probably be interested in our Intro to Line of Credit Accounts, which explores the calculations, servicing, and collections tools we have available in our lending core, LMS.