Table of Contents

Introduction

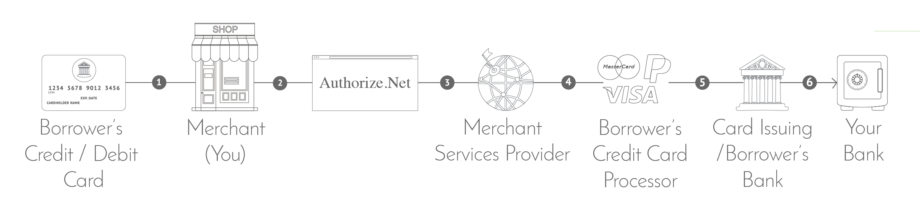

To move money from one place to another, bank card processors need to connect with acquiring banks. Typically, they work with a company called a merchant services provider to build that connection. And while some processors handle all of this themselves, others give you a choice of which merchant services provider to work through.

If your payment processor gives you that choice, you'll need to choose wisely, because some those merchant services providers aren't connected to the acquiring banks, either—they're just repackaging a service that they get from another vendor and tacking on their own fees. That's why LoanPro recommends working with Select Bankcard, who are directly connected with acquiring banks. Their relationship and integration with the banks cuts out middlemen, saving you money on every card transaction that they handle.

Use Case: Convenience

Use Case: Payments/Merchant Services/Select Bankcard

The Problem:

Suppose you decide to start taking payments through bank cards. In order to do this, you need to find a merchant services provider that will give access to the card networks. Unfortunately, your search for the right one is a frustrating process. The providers you found negotiated very high rates and the ones with some promise didn't end up approving your application. It turns out that some merchant service providers are hesitant to approve certain lending companies. As a result, transitioning to bank card payments is taking a lot longer than you had anticipated.

LoanPro's Solution:

LoanPro alleviates the headache of searching for a merchant services provider by partnering with Select Bankcard. We've done the work of sifting through different providers and found one that will provide good rates that'll make lenders pay less per transaction, approve lenders easily and avoid the cost of a flat-fee model. Our partnership with Select Bankcard creates value by taking the work off your hands and allowing your time and effort to be put towards other important responsibilities.

Using Select Bankcard

Because Select Bankcard works directly with acquiring banks, they don't charge you the additional fees that other providers like to add on. Instead, their interchange rate comes straight from the cardbrands, so you get the best pricing without the middleman fees.

Another benefit comes from their personalized integration with LoanPro. Since they're used to partnering with lenders, it's easier to get approved than it would be with other merchant services providers. They also have a support team ready to assist both before and after activation, meaning you'll get help configuring your connection with them, and ongoing support as you continue to use them, like with handling payment disputes.

Their service includes a representative dedicated to support LoanPro clients, making for a simple and seamless experience.

Common Questions

Let's take a second to answer your questions about how Select Bankcard works?

- Which payment processors require me to use a merchant services provider? Of the card processors integrated with LoanPro, only Authorize.net requires you to choose a merchant services provider.

- I want to use a payment processor that isn't integrated with LoanPro. Do I need a merchant services provider? Unfortunately, we can't really answer that for you. You're free to use any payment processor and build your own integration with them, but we only have expertise with the processors we partner and integrate with.

What’s Next

Now that you know how Select Bankcard works, you'll want to learn how to sign up with Authorize.net and create payment processors with them.