Table of Contents

Introduction

A customer in LoanPro is an individual or company that can be associated with a loan. This article covers the details of individual customer customization. We explain each section of an individual's customer information and what tools are available.

And if you're looking for information about searching for, sorting, and filtering different customers, check out our Customer Manager article.

Customer Information

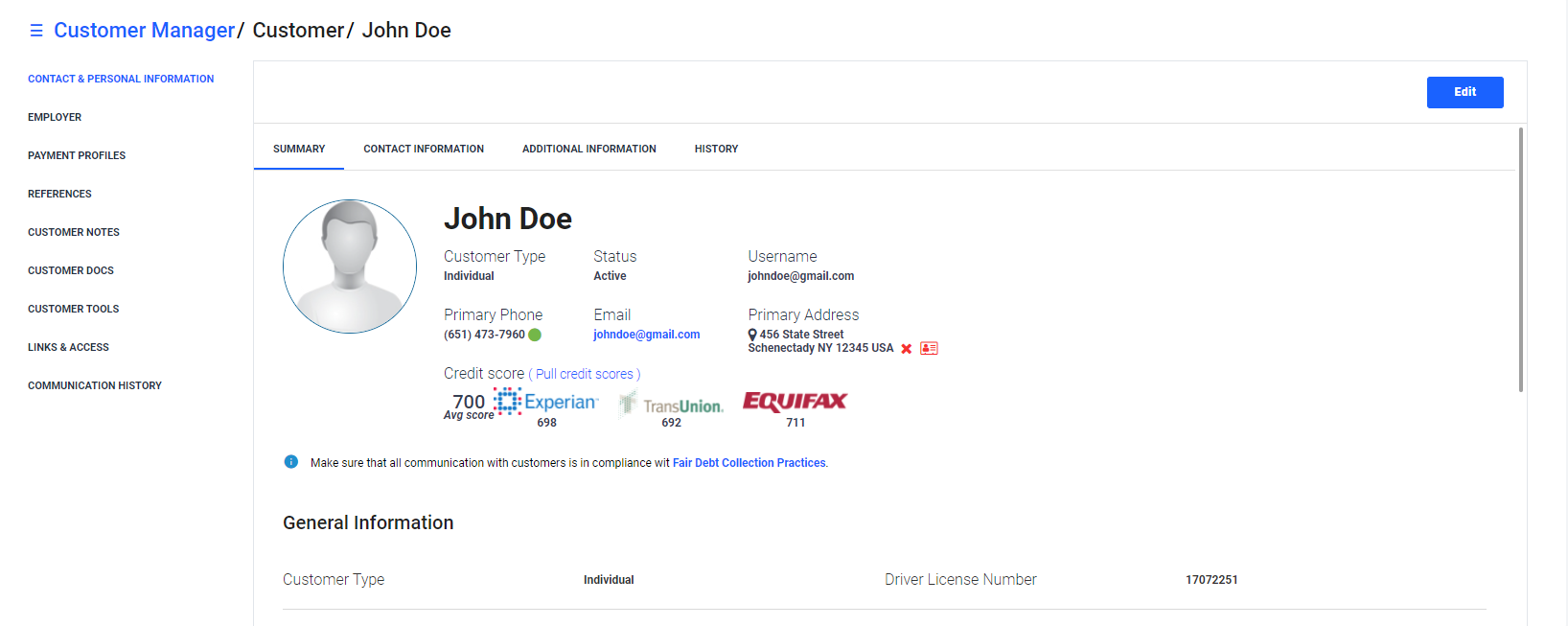

Each individual customer has their own page that displays an array of information. There are multiple ways to view a customer's information page such as via the "Customer" tab in an individual loan or via the Customer Manager. The image below is an example of how an individual customer's contact and personal information page is displayed.

On an individual customer's information page, you can update a field by clicking 'Edit'. Each customer or customer file is divided into several distinct sections listed on the left of the page. Here is a breakdown of each section:

| Section | Description |

| Contact & Personal Information | This section consists of basic information about the customer. Here, you can view contact information, a map of the primary address, and the history updates to the customer's information. |

| Employer | The 'Employer' section is designed to keep track of the information relevant to the customer’s employment. This section includes information such as employer contact information and customer salary. |

| Payment Profiles | This area allows you to add payment profiles (credit/debit cards, bank accounts) to the customer. |

| References | This section allows you to add the customer’s references. These should be individuals who know the customer well. Often, references are contacted as a collections measure when allowed. |

| Customer Note Manager | This section allows you to enter notes about the customer. There is also a section that shows system notes for the customer. |

| Customer Docs | This section allows you to upload documents that are relevant to the customer. These documents might include things like a copy of the customer’s driver license, proof of residence, proof of income, etc. This section is intended for documents that are relevant to the customer but not necessarily to a loan the customer is linked to. |

| Customer Tools | This section includes tools for OFAC InstaCheck, credit pulling, and USPS Address Validator. |

| Links & Access | This section allows you to choose what communication methods can be used for this customer. |

| Communication History | This section shows the history of communication with the customer through SMS, email, and automated phone calls. |

Common Questions

Let's answer some common questions about borrowers in LMS:

- Can I add customers in bulk? Yes, either through a .csv import or through our API. The customer import tool is particularly useful for users who would like to import many customers at once. If you have your own custom application and would like to create customers via LoanPro's API, we explain how to do so in our API – Creating a Customer article.

- Can customers self-serve on their accounts? Yes. To offer your company a personalized portal for your customers, LMS can help you create a customer website. Here, customers can make payments, update data, and manage loans. You can make this look and feel the way you'd like, as LMS provides the options to change the appearance of your customer website and configure access settings.

What's Next?

At this point, we recommend becoming familiar with each section of the customer information page if you haven't already. Each of the links in the table above provide greater detail on each section.

You might also want to read up on the Customer Manager. Here, you can view all customers and filter them with the search options.