Table of Contents

Introduction

Payments are the lifeblood of any lending business. Most lenders want to be able to collect payments in a way that won't require considerable cost or effort. Payment processing involves initiating payments, moving money, recording payments against the appropriate loans, and tracking failures and chargebacks to ensure the payments were truly received. LoanPro is integrated with and/or provides solutions for payment processing of many types. Lenders can choose the payment processing option that makes the most sense for them.

This article will explore the basics of payment processing—how money gets moved from place to place. For more on how payments are logged in LMS, check out Intro to Logging Payments.

Highlights

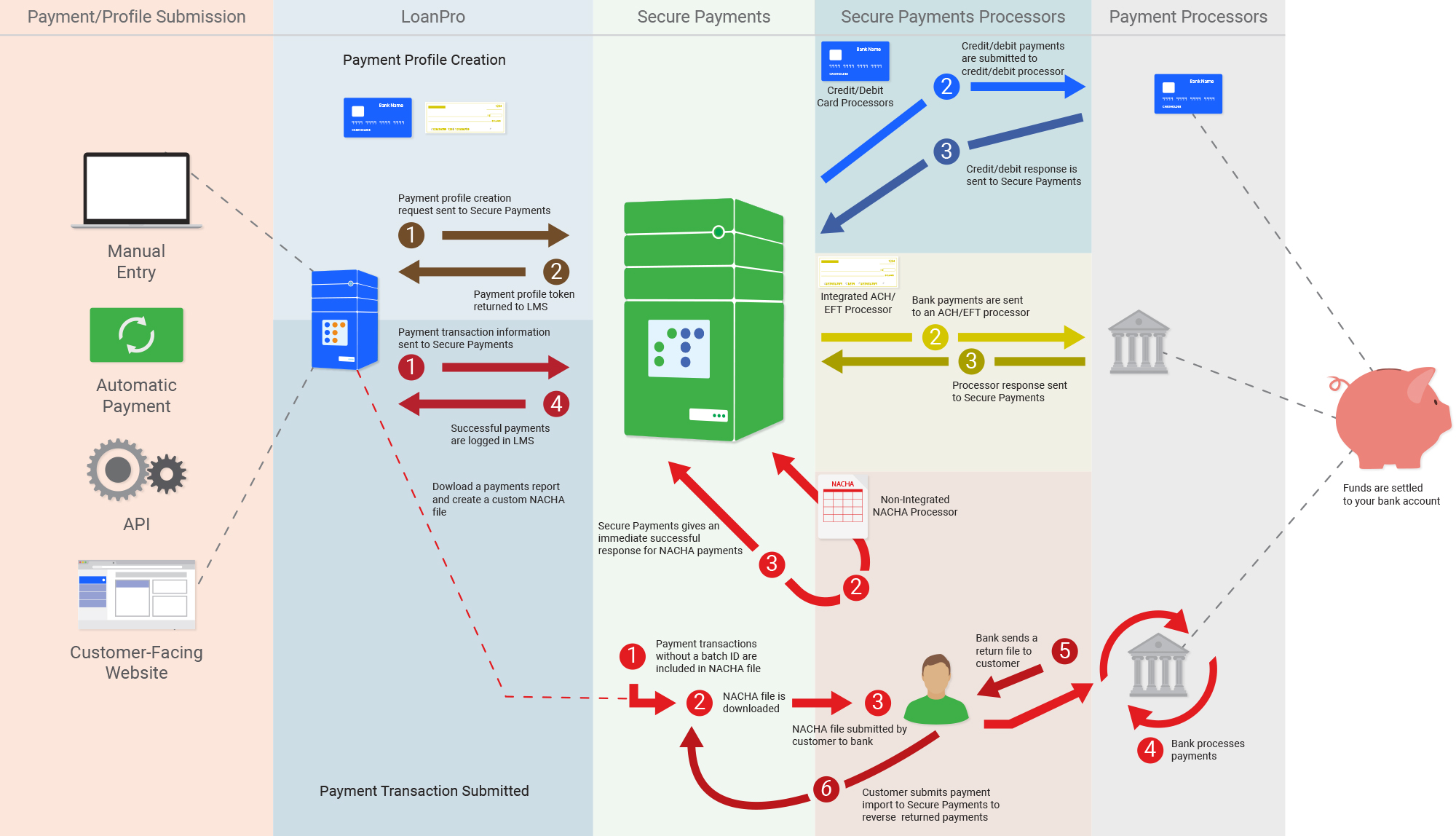

LoanPro provides options that allow payments to be submitted manually, as automatic payments, through the API, or through the customer-facing website. Regardless of how payments are submitted, the process that follows is the same.

Payment Profiles

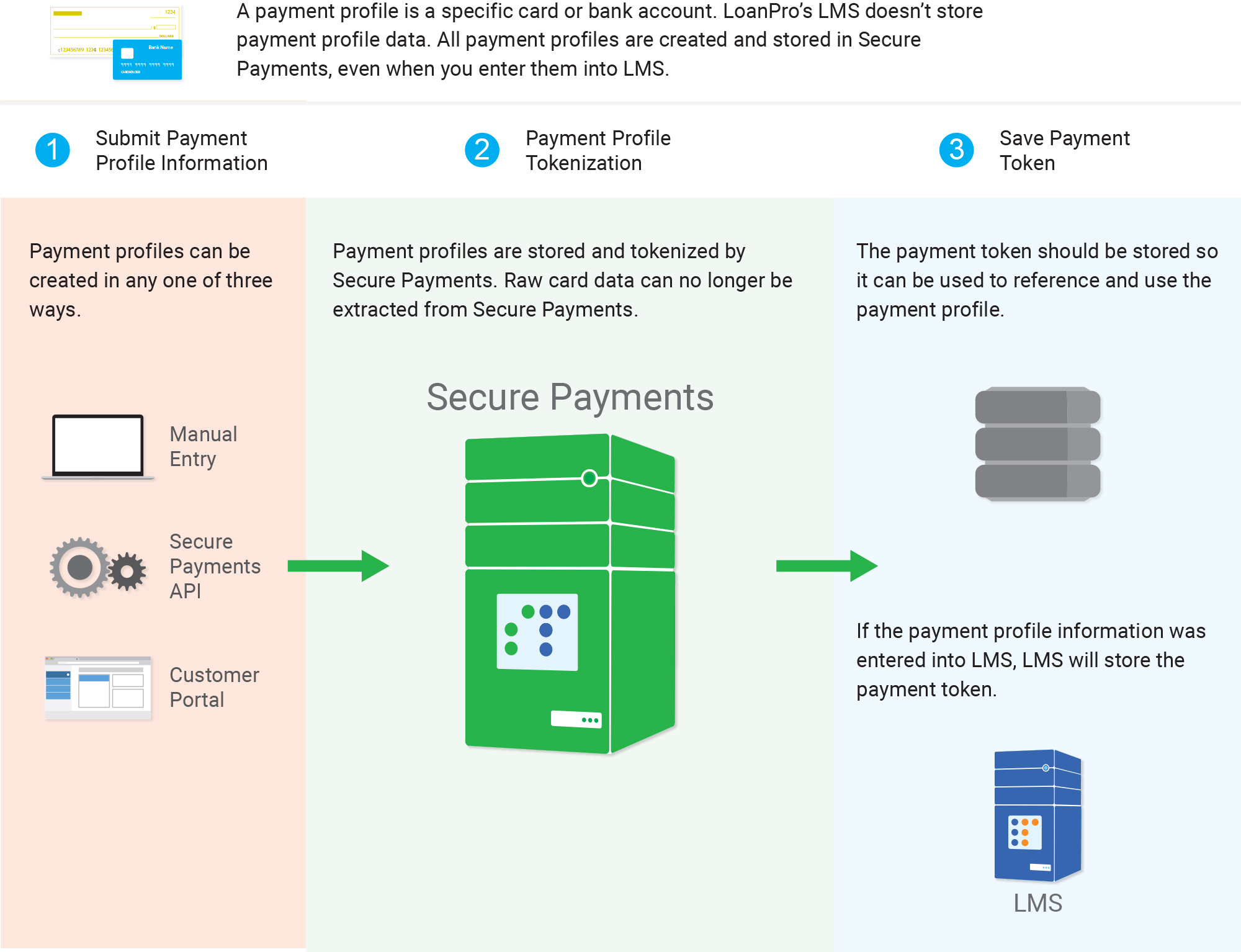

In order to process a payment, payment profile information is required. The diagram below shows how payment profiles are created in LoanPro.

PCI compliance standards dictate that payment profile information can only be submitted directly to Secure Payments. This can be achieved through an import or through an iframe in the LoanPro user interface. When payment profile information is submitted, Secure Payments will store it and then return a token to LoanPro, which LoanPro can use to reference the payment profile in the future. Payment profiles include credit/debit cards and bank accounts.

Payment Processors

There are four different types of payment processors: credit/debit card, ACH, EFT, and NACHA. For the purposes of this article, we will talk about ACH and EFT together since they both use bank account information to automatically process payments. When a payment is submitted through LoanPro, the path the processing will follow depends on the payment profile and the processor. A payment processor in Secure Payments will be linked to a specific account with one of our integrated payment processors or will be used as a way to mark transactions for inclusion in NACHA files.

Bank Cards

LoanPaymentPro, TabaPay, Repay, Payix, and Authorize.net are the bank card processors within LoanPro and Secure Payments. When a payment transaction is submitted through Authorize.Net, the amount, processor, and payment profile token will be sent from LoanPro to Secure Payments. Secure Payments will use the token to identify the payment profile and it will submit the transaction to Authorize.Net. Authorize.Net will then provide an immediate response to Secure Payments that will say whether the transaction was successful or not. If the transaction was successful, Secure Payments will send a successful response to LoanPro, and LoanPro will log the payment and save the information returned from Authorize.Net.

ACH and EFT

When an ACH or EFT payment is submitted, the amount, processor, and payment profile token are submitted to Secure Payments from LoanPro. Secure Payments will use the token to identify the payment profile and the information will be sent on to the ACH or EFT processor. If there is no immediate problem with the data, a success response will be returned to Secure Payments. This does not guarantee that the payment will be successful. Secure Payments will pass the transaction information and success response to LoanPro where the payment will be logged. If the transaction is not ultimately successful, Secure Payments will query the ACH or EFT processor to learn the status of the transaction, or the ACH or EFT processor will send information about the failed transaction to Secure Payments. Depending on your Secure Payments settings, the information may be passed to LoanPro and the payment transactions reversed.

Batch Processing

Instead of working with an ACH or EFT processing company, you can instead batch and submit those payments to the bank yourself. Since you're not hiring another company, this is usually the cheapest option per transaction, but remember that you'll also bear the costs of handling the transactions yourself. Secure Payments can help with this, but there's definitely more work on your end than there would be with a processor.

In the United States, batching is does with NACHA files, and in Canada, it's done with CPA-005 files. Both are specially-formated .txt files with a set number of rows and characters. When you create a NACHA or CPA-005 “processor” in Secure Payments, you're really just telling the system that those transactions should be batched together and turned into a file. Every day at a time you set, Secure Payments creates the file, and then you manually submit it to your bank.

Your bank will work with your borrowers' banks to move money from account to account, which usually takes a few days. Once it's finished, the bank typically send you a file with information about transactions that failed. You can use this information to create an import file, reversing these payments in LoanPro.

Settlement

Whichever payment method you use, payments will settle to the bank account you specify. LoanPro never receives funds for your payment transactions, nor do we act as a middleman of any kind.

Where Payment Processing Fits

It's difficult for a lender to scale up their operation without a good solution for processing bank card and e-check payments. Not only are these the preferred methods of payment for many customers, but they also allow for automation—not an option for lenders who only accept cash or paper checks.

Handling those payments can introduce problems of their own, especially when it comes to security and compliance. If you accidentally leave a borrower's credit card info lying around and it falls into the wrong hands, you'll be looking at fines from federal and state governments, not to mention the bad optics. But working with LMS and Secure Payments, you can rest easy, operating safely out of a PCI-compliant system where borrowers' payment information is kept safe from bad actors while staying accessible for legitimate transactions.

Expand Processing Diagram

This diagram shows how a payment transaction gets processed, going from creating a payment profile, logging transactions, and finally moving money into your account.

This Feature is Not

Let's take a second to clear up some possible misconceptions about how payment processing works in LMS and Secure Payments.

- LoanPro does not handle your relationships with payment processors for you. Our integration with different third-party payment processors makes the payment process easier, but you'll have to contact the payment processor if any issues arise.

- LoanPro does not choose your processors for you. Each processor offers a different set of expertise, and one may fit your lending model better than another. We recommend researching which processors are right for your company.

What's Next?

From here, there are several places you might want to turn. Intro to Logging Payments goes into more depth about how to actually log the payments in LMS, and discusses payments that are only logged, and don't move money with a processor. Intro to Payment Processors explains more about the companies we're integrated with for each payment method, and the lifecycle payments take through LMS and Secure Payments.

And for more about Secure Payments and its features, check out Intro to Secure Payments and Intro to Payment Tools.