Table of Contents

Introduction

We'd say it's safe to assume that most people understand what a payment is on a basic, conceptual level—a transfer of something of value for a good or service, but payments on loans have a little more depth. The payment isn't just a single exchange, but one part of a larger exchange. And since loans have interest, fees, and possibly escrow, there are several places where the money can go on the account. There's also questions of timing—since the payment was scheduled for a set date, what do you do if it comes in early? And will the borrower pay in cash, with a card, through a bank account, or something else entirely?

In LMS, we have tools that can answer all these questions, and help your employees log payments with ease, accuracy, and efficiency. This article will explore how logging payments work in LMS—how it's done in the software, what options are available, and how they'll affect loans. We'll also touch on payment processing, how the money actually gets moved from a borrower's account into yours.

For more on processing, you should read Intro to Payment Processing. And for a walkthrough in the software, check out Logging Payments.

Highlights

The first thing to note is that LoanPro separates payments into two tasks: logging a payment on an account, and actually processing the money movement. Payments are logged in LMS, and if it's a bank card or e-check payment, LMS then tells our PCI-compliant software Secure Payments to move money from the borrower's account into yours.

Logging a Payment

There are several tools for logging payments in LMS, each with their own strong suits.

Individual Payments

This is the simplest way to log a payment, and the one we walkthrough in our Logging Payments article. Just open a loan, click Log Payment, and let the system walk you through the rest of the steps.

AutoPays

If you don't want to manually log every payment, AutoPays can automatically draw money from a borrower's bank card or account. For more on these, check out Intro to AutoPays.

Imports

Imports let you upload a .csv file with payments for multiple loans at the same time. For general info, read Intro to Imports, and for the payment import specifically, read Import Example – Payments.

Customer Website

LoanPro offers a customer-facing website, which borrowers can use to apply for loans, view their accounts, add payment profiles, post payments, and set up AutoPays. For an overview of what they'll see, check out Customer-Facing Website Customer View.

Note that when payments are logged here, they'll use your payment defaults.

API

If you use another software to accept payments, you can integrate them into LMS with our API. Check out the Payments section of our ReadMe documentation.

Payment Settings

Regardless of what tool you use to log them, you'll have the same options for how the system calculates that payment on the loan. Our article Logging Payments will breakdown each of these settings and what options you have, but here we'll give a quick explanation of each. Note that these are saved at the payment level, meaning that you can create payments with different settings on the same account.

| Payment Setting | Description |

| Recovery Payment | If you've already charged off a loan and taken it off your books, but then receive a payment, LoanPro can help you keep your account straight by logging it as a recovery payment. They will still apply towards the loan balance and move money like normal payments, but are distinct in reports. |

| Payment Type | This determines the order in which money goes to different parts of the loan, like principal, fees, and interest. If a borrower pays the full amount on the due date, this won't make a huge difference, but it can have a larger impact when borrowers make partial payments and there's not enough money to cover everything due. |

| Date | You can change when the payment applies to the loan. |

| Amount | You can either enter an amount manually, or select a set amount, like everything that's currently due. |

| Payment Method | This refers to how the borrower is paying you—cash, bank card, checks, e-check, or whatever else. Our Cash Drawer tools can help you manage cash transactions, and we're integrated with several payment processors to handle bank cards and e-checks. If you want to add custom payment methods, like Dogecoin or Applebee's gift certificates, feel free, but LoanPro doesn't have tools to move those into your account. |

| Advanced Settings | These settings control the finer points of payment calculations, like how it affects interest accrual or what the system does when borrowers make early payments. Check out Logging Payments for an explanation of each. |

| Payment Profile | If this is a bank card or e-check payment, then the payment profile is the specific card or account the borrower is using. (You can create and select profiles in LMS, but they're saved in Secure Payments to maintain PCI compliance.) If it's any other payment method, you won't need to enter a profile. |

| Payment Processor | Payment Processors are companies who handle the actual movement of money from one account to another. LoanPro is integrated with several for bank cards, e-checks, or both. |

| Convenience Fee | You can choose to a percentage, dollar amount, lesser or greater of the two, or waive it entirely. |

Where Do Payments Fit?

When it comes to understanding how payments actually work in the system, it's important to know how LoanPro's Loan Management System (LMS) categorizes payments, the breakdown of the overall process, and how Secure Payments fits into the picture.

Logging and Processing

LMS separates payments into two broad categories: those that are only logged and those that are both logged and processed. We categorize payments like this because the payment methods that they consist of work differently on a fundamental level within LMS.

Only Logged

Our first category is logged payments. This category is the simpler of the two, as it only consists of one payment method—cash payments. We call these "logged" payments since LMS is not directly involved in these transactions and only records a log. If you have borrowers that prefer to make payments with cash, LMS can handle this. While the software can't physically take cash from your borrowers (that's where you come in), our implementation of Cash Drawers makes it easy for you and your loan servicers to receive and track cash on a daily basis.

Logged and Processed

"Logged and processed" payments, on the other hand, are payments that LMS is directly involved in. These are the transactions that occur within LoanPro's software, and it encompasses payments involving bank cards and integrated bank transfers. Logged and processed payments also include payments made through customer-facing payment portals and AutoPays. When a payment that falls under this category occurs within LMS, the transaction is completed within the software via our payment integrations and then logged within the LoanPro UI.

The Payment Process

Now that you understand how LoanPro categorizes payments, let's take a look at the overall process. We'll keep this breakdown simple and go into greater detail in our other payments articles.

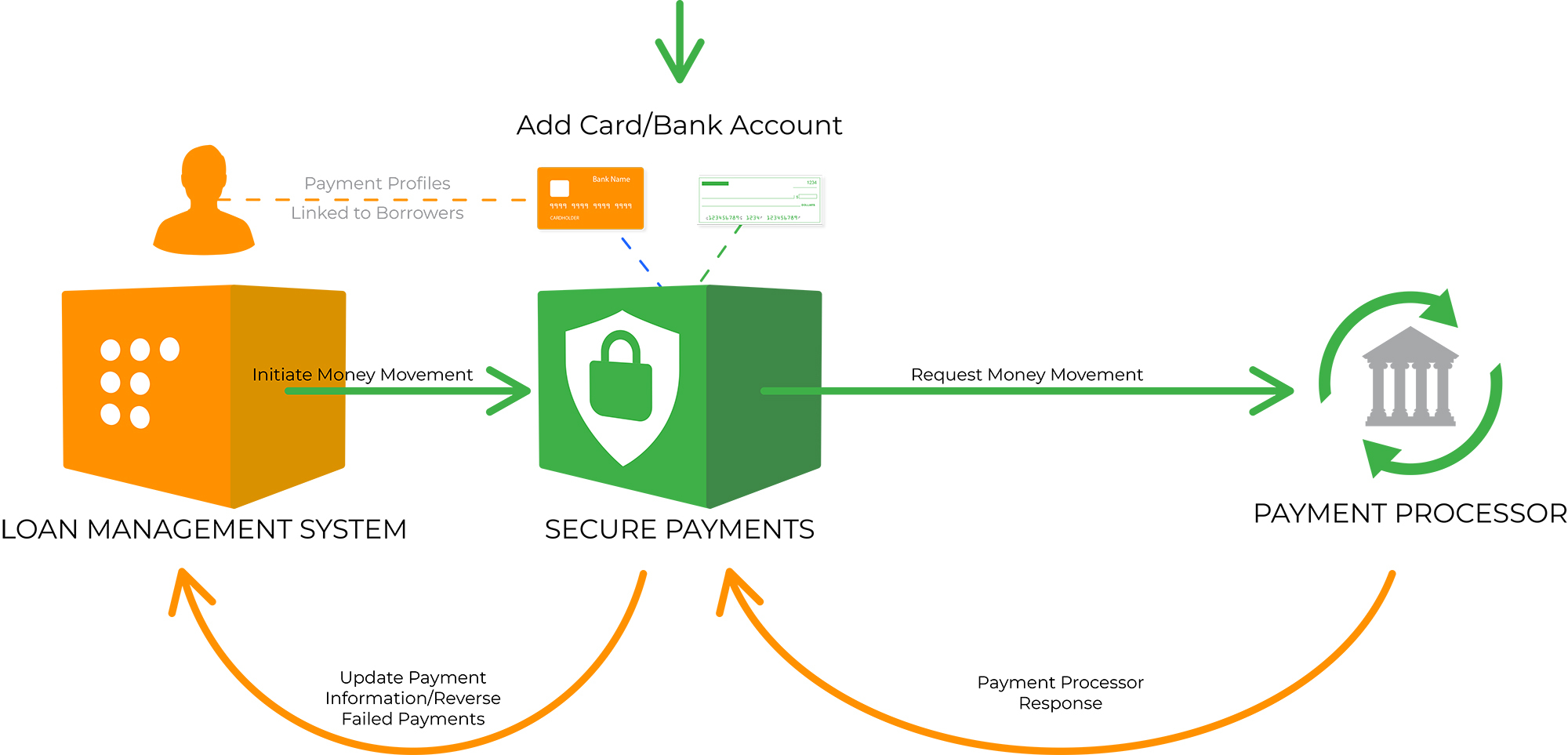

- The process begins with the creation of a payment profile in LMS. While it seems like you are creating these in LMS, you are actually using Secure Payments via an iframe, which is kind of like a bridge between two websites. The payment profile is then selected as the method for the payment.

- The payment is initiated and processed in LMS, then it's sent to Secure Payments.

- Secure Payments then sends the payment information to the corresponding payment processor where it's processed on their end.

- Depending on the success or failure of the payment with the payment processor, a response is sent to Secure Payments and then logged. Secure Payments relays this information back to LMS so that your payment records match in both places.

- LMS then updates the loan calculations to reflect the payment.

Here's a diagram of how everything works together:

Secure Payments' Role

The safety of your payment information is always a top priority of ours. To ensure your information is always safe, we created Secure Payments, a PCI-compliant product separate from LMS. Your borrowers' payment profile information is stored here, and we tokenize each profile to ensure security. LMS stores only basic payment information and uses the token in Secure Payments to initiate transactions. Like we mentioned, the two products are separate, but they communicate with each other to match payment information.

Secure Payments is also where you will create payment processors—third-party businesses that facilitate the transfer of funds. Once you create a processor in Secure Payments, it can be used for payments in LMS. However, we'll cover that topic in greater detail in our intermediate-level article.

This Feature is Not

- Payments are not processed in LMS. The actual movement of money is all handled within Secure Payments. When you log a payment in LMS, it does two things: affect loan calculations, and (if you have payment processors and profiles set up) tell Secure Payments to start moving money.

- Payments aren't instantaneous. Bank card payments come close, usually only taking a second or two. ACH has traditionally taken three to five business days, but in recent years, the ACH networks have worked to speed up the processes. Same-day processing is possible as long as payments are made before a daily deadline (and they're not international or very large payments, which take some extra time to clear).

What’s Next?

At this point, you have a good foundational understanding of how payments work. Now, we suggest you read Logging Payments, which explains how to set up payment profiles and how to make payments within LMS. We also recommend reading Intro to Secure Payments for an overview of the product and Intro to Payment Processors for more information regarding payment processors—including a list of the available processors integrated with LoanPro.